Gas flood washing past local industries

An industry leader has slammed Australia’s lack of effective energy policy, saying the nation is driving up its own gas prices at the cost of local innovation.

An industry leader has slammed Australia’s lack of effective energy policy, saying the nation is driving up its own gas prices at the cost of local innovation.

James Fazzino is the CEO of Incitec Pivot, Australia’s largest fertiliser supplier and a big producer of mining explosives.

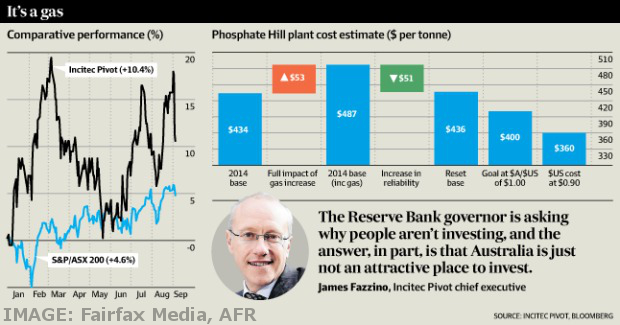

The Incitec boss says gas costs at the company’s Phosphate Hill fertiliser plant in Queensland will increase by $50 million a year in 2015-16.

The price rise will come as several major LNG projects on the east coast come online and start exporting gas.

Analysts say energy prices will rise from their current level of $2 a gigajoule up to $12 a gigajoule in coming years.

As a result, Fazzino says Incitec will build its new $US850 million ammonia plant in Louisiana rather than in Australia, as a “strategic response” to high local costs.

The United States has an energy policy that keeps domestic prices down in order to encourage value-added manufacturing.

Australia, despite its wealth of gas supplies, has no such policy.

“The state of Louisiana is open for business,” Mr Fazzino told a recent investor conference.

“They continue to ring us every month and ask, ‘What else can we do’ because they are about employing people in Louisiana.”

“The Reserve Bank governor is asking why people aren’t investing, and the answer, in part, is that Australia is just not an attractive place to invest.”

He said Australia had simply imported Asia’s energy inflation by linking so closely with that market, which now means that too much gas is headed for export.

“Next winter there are going to be some households in Victoria that choose not to turn on their heater because they can’t afford to buy the gas,”

“For me that’s a far bigger issue than us having to pay more for our gas.

“There’s going to be a $2 billion transfer from households to the energy companies. That’s a train wreck. Someone needs to show some leadership and fix this.

“Are we looking at a market failure here where we’ve had a bunch of gas companies being able to monopolise the market and they’re extracting rents?”

Mr Fazzino agrees with a Business Council of Australia report on competitiveness which argued in favour of value-adding in fields of natural advantage to Australia, like mining, agriculture, chemicals and food processing industries.

The Australian Financial Review published the following table to show Incitec’s future costs and relative success overseas.

Print

Print