ANZ expects loan hit

ANZ has put $1 billion aside for coronavirus-related loan losses amid a 51 per cent slump in profits.

ANZ has put $1 billion aside for coronavirus-related loan losses amid a 51 per cent slump in profits.

The bank this week announced “impairment charges” to cover expected bad loans of $1.67 billion, in addition to a $815 million hit to the value of its Asian investments due to the COVID-19 pandemic.

It will defer its decision on whether to pay a dividend until more is known about the fallout from COVID-19.

That leaves the bank with a $1.55 billion net profit for the half-year ended March 31.

ANZ paid a dividend of 80 cents per share at the same time last year, but with earnings per share now at just 50 cents, the move will not be repeated yet.

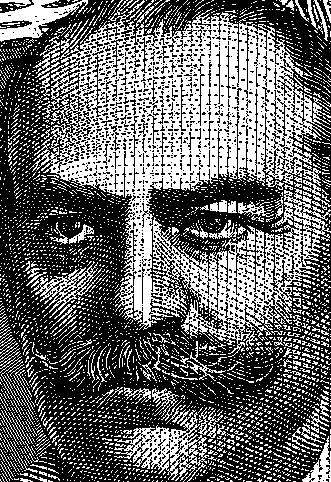

But ANZ's chairman David Gonski says it is “not about our current financial position and ANZ has not received any concerns from [bank regulator] APRA regarding our level of capital”.

“The board agrees with the regulator's guidance that deferring a decision on the 2020 interim dividend is prudent given the present economic uncertainty and that making a decision at this time would not have been appropriate,” he said.

The comments came after rival NAB elected to pay out a 30-cent per share dividend. NAB surprised many when it brought forward its results earlier this week.

AMP Capital Australian equities portfolio manager Dermot Ryan says NAB’s capital raising will dilute the value of existing shareholdings.

“Some thought we were too bearish calling that aggregate bank dividends would at least halve at the start of the month, but banks have been prudent and need to use their organic capital generated to boost their balance sheets so they can continue lending and supporting our economy in the rebound,” he wrote, analysing ANZ's result.

“Paying dividends using a DRP is the same as issuing equity and, with banks now mostly trading under book value, issuing equity is dilutive to existing investors.”

Print

Print